We’ve already analyzed tens of thousands of financial research papers and identified more than 700 attractive trading systems together with hundreds of related academic papers.

Browse Strategies- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Upgrade subscription

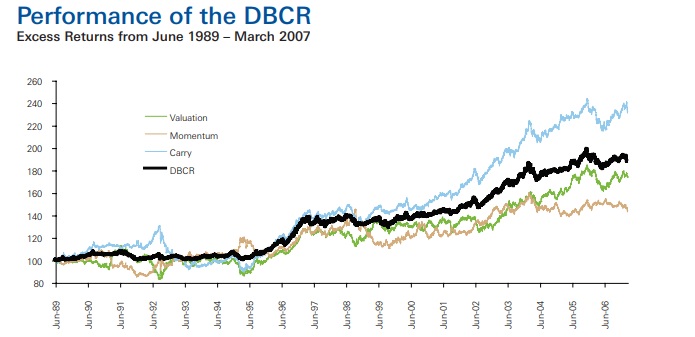

The end of the Bretton Woods system and the emergence of freely floating currencies have allowed the existence of systematic investing strategies in the currencies. Those FX strategies are already well-researched and are supported by academic work. Among them, the carry trade strategy is probably the most well-known in the currency market and also probably the most profitable one.

In the past decades, the daily volume in the currency market has increased nearly tenfold. The FX market is currently dominated by large and sophisticated investors. However, the idea of the carry trade strategy is really simple, strategy systematically sells low-interest-rates currencies and buys high-interest rates currencies trying to capture the spread between the rates. Moreover, considering a longer time frame, there is a low correlation between the returns of employing the carry strategy and the returns which could be gained from investing in more traditional asset classes such as equities and bonds. That makes a carry strategy a proven and profitable way how to diversify a portfolio. However, the investor must pay attention to the carry trade strategy’s correlation with global financial and exchange rate stability.

Fundamental reason

Overall, in the academic literature, there is a consent that the foreign exchange carries trade anomaly works. For example, Acemoglu, Rogoff, and Woodford in the Carry Trades and Currency Crashes says “A “naive” investment strategy that chases high yields around the world works remarkably well in currency markets. This strategy is typically referred to as the carry trade in foreign exchange, and it has consistently been very profitable over the last three decades.”

The academic theory says that according to the uncovered interest rate parity, carry trades should not yield a predictable profit because the difference in interest rates between two countries should be equal to the rate at which investors expect the low-interest-rate currency to rise against the high-interest-rate one. High-interest rate currency often does not fall enough to offset carry trade yield difference between both currencies, because the inflation is lower than that which was expected in the high-interest-rate country. Additionally, the carry trade trading often weakens the currency that is borrowed, and the reason is simple -> investors convert the borrowed money into other high-yielding currencies. This causes additional price drift. Capturing those gains is possible by a systematic portfolio rebalancing.

- Unlocked Screener & 300+ Advanced Charts

- 700+ uncommon trading strategy ideas

- New strategies on a bi-weekly basis

- 2000+ links to academic research papers

- 500+ out-of-sample backtests

- Design multi-factor multi-asset portfolios

Backtest period from source paper

1989-2009

Confidence in anomaly's validity

Strong

Indicative Performance

7.27%

Notes to Confidence in Anomaly's Validity

Notes to Indicative Performance

per annum, performance is calculated from Deutsche Bank Currency Carry USD Index

Period of Rebalancing

Monthly

Notes to Period of Rebalancing

Notes to Estimated Volatility

volatility is calculated from Deutsche Bank Currency Carry USD Index

Number of Traded Instruments

10

Notes to Number of Traded Instruments

it depends on investor’s need for diversification (10-20)

Notes to Maximum drawdown

Complexity Evaluation

Simple strategy

Notes to Complexity Evaluation

Financial instruments

CFDs, forwards, futures, swaps

Simple trading strategy

Create an investment universe consisting of several currencies (10-20). Go long three currencies with the highest central bank prime rates and go short three currencies with the lowest central bank prime rates. The cash not used as the margin is invested in overnight rates. The strategy is rebalanced monthly.

Hedge for stocks during bear markets

No - FX Carry is strongly correlated to the business cycle and therefore is susceptible to drawdown during periods of stress (as equities are too) …

Out-of-sample strategy's implementation/validation in QuantConnect's framework

(chart+statistics+code)